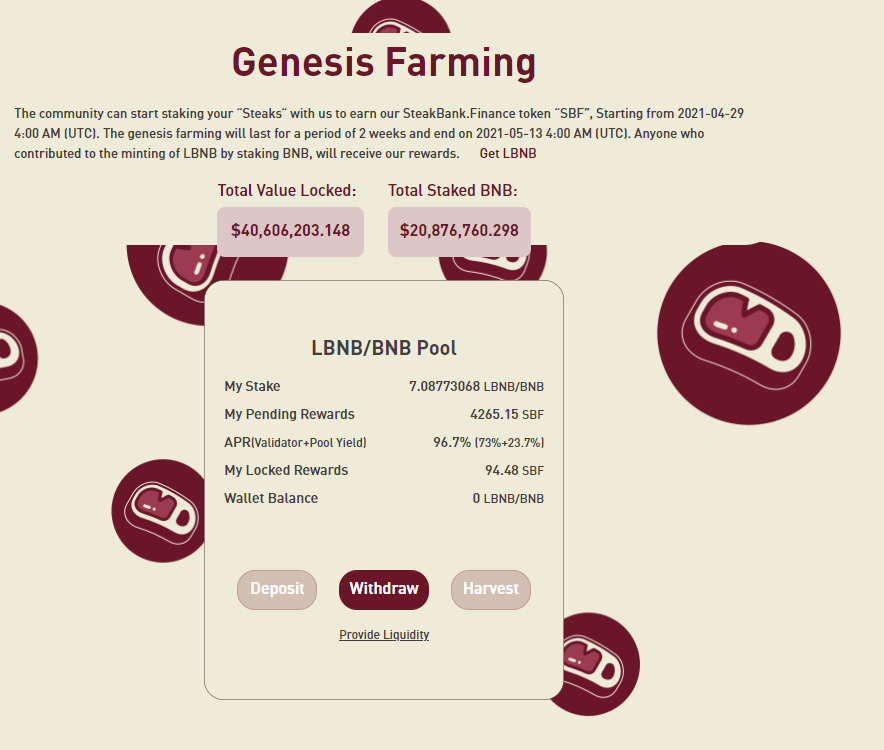

Did a stake into Steakbank, a project on Binance chain 2 wks back on recommendation from a friend. BNB into LBNB. Then farm BNB/LBNB.

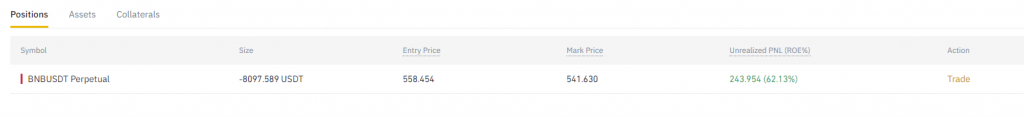

To hedge against against BNB dropping, did a hedge by shorting equivalent amount via Binance futures. (I was totally wrong on the direction, the next day after i hedged, crypto market cheong. Losing money for doing the right thing. My crypto fren said that only middle intelligence people hedge. Guess he was right this time haha)

Also tested putting SGD into crypto with Gemini. they use Xfers but bypassed the 30k/year limit.

Guess the hedge is a scratch. But on hindsight, if i go in naked, i dun think I would close out the trade when BNB reaches 650. Would still hedge the next round given a choice.

Update 14May

| received my SBF from airdrop into my MetaMask wallet |

| removed liquidity from LBNB/BNB pool at pancake swap |

| unstake all LBNB for BNB (pending) |

| convert 1/2 of my SBF to BUSD on pancake swap, leave the rest to see if it runs |

| to sell off all BNB and remove futures hedge (pending) |

~3+% returns for 2 wks on farming with no IL risk. pretty decent